Simpson Manufacturing: Nearing An Inflection Point (NYSE:SSD)

Evkaz/iStock via Getty Images

Given the rise in interest rates that we have seen lately, concerns have mounted over any company with ties to the construction space. Even businesses that continue to post robust results on both the top and bottom lines have been victims of this market. A great example of this can be seen by looking at Simpson Manufacturing (NYSE:SSD), an enterprise focused on the design, engineering, and manufacturing of wood and concrete construction products such as trust plates, fasteners, mechanical anchors, adhesives, and more. Unfortunately, in recent months, shares of the company have not only followed the market lower, but managed to underperform the market. This comes at a time when revenue and profits are rising nicely and when shares are trading at rather cheap levels. This is not to say that the company won’t experience some pain moving forward. But given how cheap the stock looks now, it’s difficult to imagine a realistic scenario where shares would be materially overpriced.

A nice play on the construction market

Back in March of this year, I wrote an article that took a rather neutral stance on Simpson Manufacturing. In that article, I chronicled the company’s rise, from a revenue and profitability perspective, over the prior few years. I concluded that the firm was a quality operator in the construction materials market, but I also recognized that some of the growth it experienced recently may have been transitory. At that time, I felt as though shares of the company were more or less fairly valued, leading me to rate it a ‘hold’ to reflect my view that shares should more or less match the returns of the broader market for the foreseeable future. Since then, the company has actually underperformed the market to some degree. While the S&P 500 is down 13.8{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9}, Simpson Manufacturing has generated a loss for investors of 17.3{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9}.

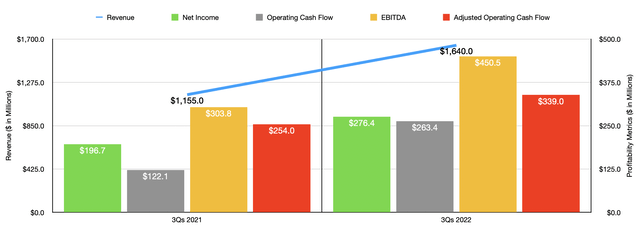

Author – SEC EDGAR Data

You would think that if the company was underperforming the market like this, the financial picture of the business was showing signs of weakness. But that is not the case. If anything, the opposite is taking place. To see what I mean, we need only cover results through the third quarter of the company’s 2022 fiscal year. For the first nine months of the year as a whole, revenue came in at $1.64 billion. This represents a 42.1{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} increase over the $1.15 billion generated the same time last year. Most of this growth came from the company’s North American operations, with sales jumping by 34.7{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} from $989.7 million to $1.33 billion. On a percentage basis though, the real growth came from its presence in Europe, with sales skyrocketing 90.7{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} from $155.6 million to $296.6 million. Such rapid growth is rarely the result of organic activities. But this is one of those rare exceptions where that is the case. From 2021 through today, the firm has raised prices four separate times to offset rising raw material costs. The firm also benefited to the tune of $147.8 million from its acquisition of ETANCO.

With this rise in revenue, we also saw improved profitability. Net income for the company rose from $196.7 million to $276.4 million. This came at a time when gross margins for the company actually worsened, dropping from 48.2{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} to 45.1{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9}, largely as a result of its aforementioned acquisition. Other profitability metrics followed a similar trajectory. Operating cash flow shot up from $122.1 million to $263.4 million. If we adjust for changes in working capital, it still would have risen from $254 million to $339 million. Meanwhile, even EBITDA for the company improved, rising from $303.8 million to $450.5 million.

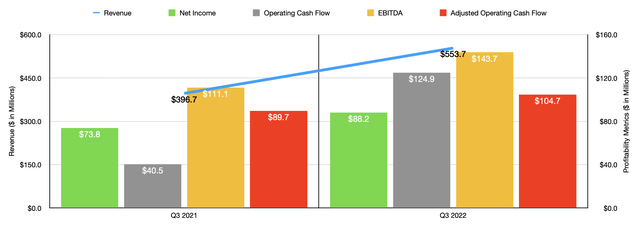

Author – SEC EDGAR Data

Obviously, results for the year-to-date period are definitely important. However, we also need to pay attention to the most recent data on its own. After all, we are dealing with changing economic conditions. Thankfully, in the third quarter on its own, the firm has done quite well, with revenue of $553.7 million dwarfing the $396.7 million reported one year earlier. The same factors that impacted the year-to-date results for the company have also impacted, in a positive way, the company’s results for the third quarter. Meanwhile, profitability figures for the company continue to improve. Net income rose from $73.8 million to $88.2 million. Once again, the gross margin for the company suffered, falling from 49.9{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} to 44.2{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9}, with much of that due to the aforementioned acquisition. At the same time, operating cash flow more than tripled from $40.5 million to $124.9 million. If we adjust for changes in working capital, it would have risen from $89.7 million to $104.7 million. Even EBITDA remained on the rise, climbing from $111.1 million to $143.7 million.

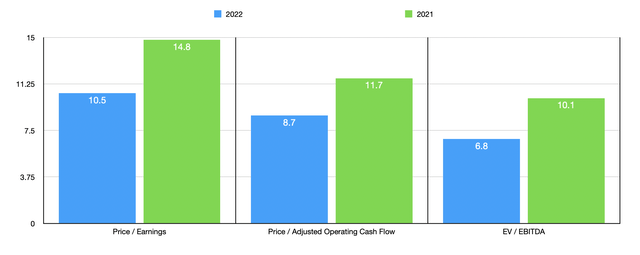

Author – SEC EDGAR Data

Although management has provided some thoughts on how 2022 as a whole might end up, we don’t really have much to go on that would be of value. Instead, if we just annualize results experienced so far for the year, we would get net income of $374.3 million, adjusted operating cash flow of $450.8 million, and EBITDA of $634.7 million. These numbers would imply a forward price to earnings multiple of 10.5, a forward price to adjusted operating cash flow multiple of 8.7, and a forward EV to EBITDA multiple of 6.8. Even if results revert back to what we saw in 2021, these multiples would not be unreasonable, coming in at 14.8, 11.7, and 10.1, respectively. When I last wrote about the company, the data for the 2021 fiscal year implied multiples of 18.4, 14.5, and 10.7, respectively. So in two of the three manners, shares have gotten meaningfully cheaper. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, the companies ranged from a low of 3.9 to a high of 18. In this case, three of the five were cheaper than our prospect. Using the price to operating cash flow approach, the range is from 3.2 to 20.9, with two of the five firms being cheaper than our target. And when it comes to the EV to EBITDA approach, the range is between 2.8 and 11.5. In this scenario, four of the five are cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Simpson Manufacturing | 10.5 | 8.7 | 6.8 |

| Builders FirstSource (BLDR) | 3.9 | 3.2 | 2.8 |

| Armstrong World Industries (AWI) | 18.0 | 20.9 | 11.5 |

| Tecnoglass (TGLS) | 11.2 | 11.6 | 6.7 |

| Owens Corning (OC) | 6.6 | 6.2 | 4.5 |

| UFP Industries (UFPI) | 7.0 | 6.1 | 4.4 |

Takeaway

What we have available to us today is a company that is trading on the cheap on an absolute basis but in a range that is similar to its peers. At some point, financial performance probably will weaken, especially if interest rates have the impact that we expect them to. The company is bolstered by the fact that it has no debt and has cash on hand of $301.2 million. That provides a great deal of flexibility and protection for shareholders. Overall, I would say that the risk of a permanent loss of capital for shareholders is very low. But I wouldn’t be surprised, given market conditions, of maybe some temporary pain. Given how cheap the stock is right now though, it is getting rather tempting. But when factoring in the economic concerns, I do think it still makes more sense as a ‘hold’ for now. But if the picture gets any more favorable for investors, that rating might change.