Allstate looks to ‘mitigate repair costs’ through agreements, expects little pushback on auto insurance rate increases

The strategy may perhaps signal that the promises settlement approach is about to get even much more tough as Allstate seeks to decrease the amount of pounds it spends on repairs.

“Beyond expense reductions and charge improves, we’re also leveraging superior assert capabilities to mitigate reduction price force for our buyers,” Glenn Shapiro, president, Personal Assets-Liability, informed buyers on Feb. 3.

“We’re broadening strategic partnerships with part suppliers and maintenance services to mitigate restore charges. We’re applying highly developed assert analytics and predictive modeling equipment to optimize mend versus complete decline selections and to evaluate the probability for injuries and legal professional representation on casualty claims,” Shapiro said.

“The bottom line is we are highly self-assured in our capacity to restore vehicle profitability to targeted degrees,” he explained.

On the income facet of the ledger, Allstate has introduced to the marketplace that they are rising their fees as their charges rise, and that they see no cause why regulators at the condition level would not approve their “justifiable and supportable” new rates.

Allstate lifted car insurance policies rates an regular of 7{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} in 25 states in the previous quarter of 2021, and will keep on looking for larger prices, even in states that have previously viewed an maximize, executives instructed buyers.

Shapiro reported that boosts in automobile severity “reflect inflationary tension across coverages, with a selection of underlying components of severity rising speedier than core inflation.”

Allstate did not answer to a request from Repairer Driven Information to outline how “broadening” their relations with the insurance company could impact the maintenance retailers and areas suppliers it functions with, who are facing inflationary pressures of their have.

Vehicle Insurance Reduction Costs Impacted by Inflationary Pressures

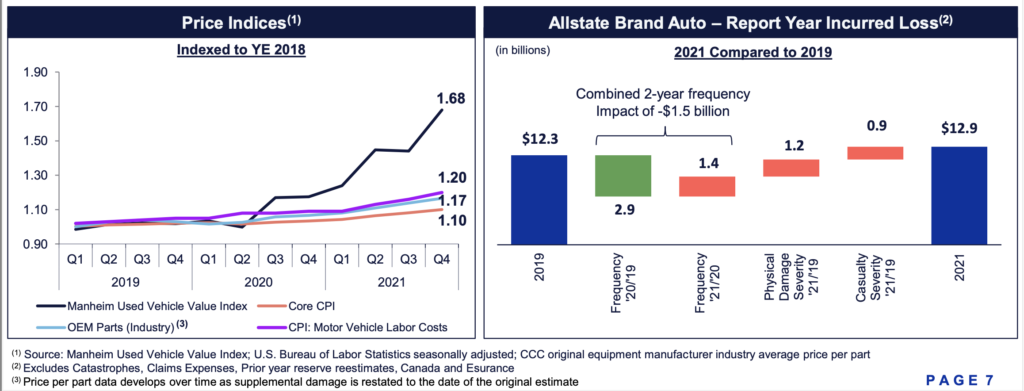

Vehicle maintenance costs have contributed to a 43{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} maximize in Allstate’s charges in Q4, to over $11.6 billion, the enterprise said in a assertion. Allstate’s P&C blended ratio for its automobile insurance enterprise rose to 104.3{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9}, indicating that it put in $104.30 for every $100 it collected in rates. By comparison, the put together ratio for its homeowners’ policies was 87.1{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9}.

2021 was a 12 months of “two unique halves as it related to profitability of vehicle insurance plan,” Allstate CEO Tom Wilson mentioned. When earnings for the very first six months totaled much more than $1.7 billion, many thanks to lower incident frequency and offset improved statements severity, that transformed in the 3rd and fourth quarters.

“In the second 50 percent of the year, vehicle claim frequency ongoing to enhance toward pre-pandemic ranges and the cost of fixing automobiles and settling bodily harm statements accelerated,” Wilson mentioned.

Shapiro mentioned auto assets problems frequency rose 21.5{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} in the fourth quarter of 2021 compared to 2020, but was down 13.3{e3fa8c93bbc40c5a69d9feca38dfe7b99f2900dad9038a568cd0f4101441c3f9} compared to 2019.

Despite the fact that miles driven are approaching pre-pandemic levels, he stated, which is been moderated by a “meaningful” alter in time-of-working day driving.

Shapiro stated larger applied automobile values and climbing “OEM sections and labor rates” in 2021 have resulted in greater severities and coverages like collision and assets problems.

Q4 2021 The Allstate Company Earnings Convention Phone

Allstate raises vehicle insurance coverage charges as declare severity raises, discusses value of telematics products

Allcorp – Q4 2021 Earnings Presentation – Closing

Qualified testifies Allstate overcharged some policyholders full of practically $1B

Photographs

Highlighted impression: An Allstate Insurance policy workplace in Houston, Texas. (Brett_Hondo/iStock)

Share This: